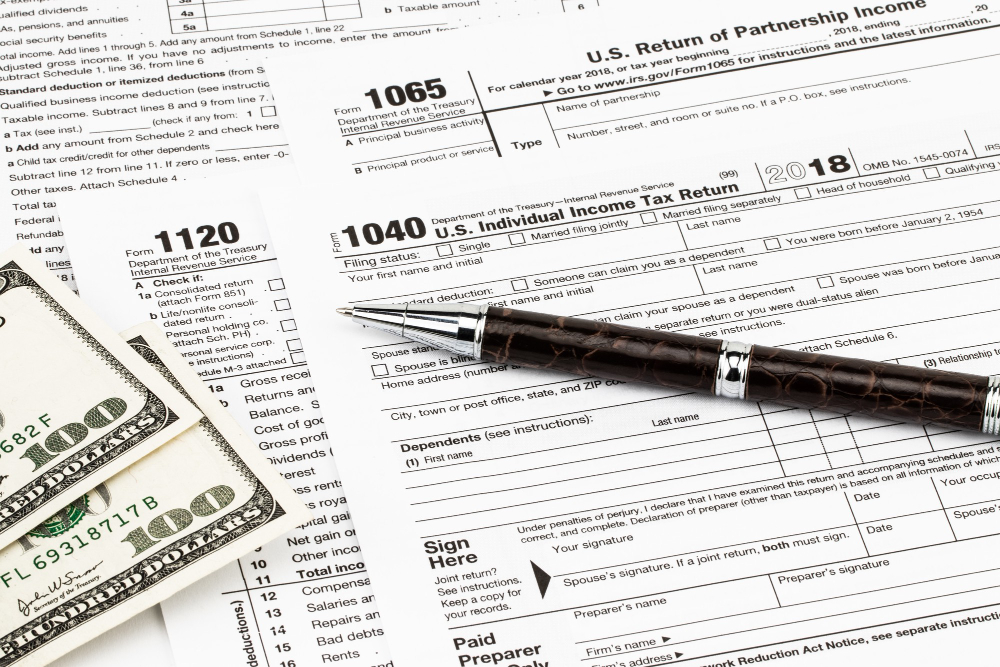

From complexity to clarity:

Simplifying taxes for American businesses

Tailored Solutions

Highlight the importance of offering personlized tax & accounting solutions to fulfill the unique need & goals of each client.

Regulatory Compliance

Stress the significance of staying complient with the ever changing tax laws & regulations in the united states.

Strategic Planning

Showcase the value of proactive tax planning as a means of achieving long term financial objectives by enhancing financial performance.

Providing the best

Tax & Accounting Services

We at TaxicMinds, offer expert financial services tailored to your needs. From tax planning and compliance to comprehensive accounting solutions, we help American businesses navigate through financial complexities, ensuring your business thrives with precision and reliability.

- Personalized Services

- Tech-Driven Innovations

- Trusted Data Security Measures

- On-time Service Delivery

Our Host Of Services Include

Leading taxation services in the USA through expert advice, compliance and strategies for businesses as well as individuals.

Trust us for unmatched guidance and results with our top sales tax experts, meet compliance, have audits and strategic planning.

With premium payroll solutions, get accurate, efficient, and compliant services personalized to your business needs. Experience excellence today.

Get trusted auditing services with comprehensive, accurate & expert solutions for your peace of mind.

Optimize your financial processes today to efficiently manage and process invoices, ensuring timely payments.

From precise reporting to strategic analysis, we provide the expertise you need without the overhead costs. Partner with us to optimize operations, enhance decision-making, and unlock new avenues for success.

Cleaning up books for tax preparation is crucial for ensuring accuracy and compliance with tax regulations. Our bookkeeping services specialize in this area, meticulously organizing and reviewing your financial records to identify any discrepancies or errors.

Your path to stress

free tax solutions begins here

What they’re talking

about our services

Get a quote to get started

with our services right away.

Together We Drive Your Business To Success

At TaxicMinds, we partner with you to ensure financial success through expert tax strategies, personalized services, and unwavering commitment.

Prioritize Scalability

Choosing the appropriate system and technology can significantly accelerate your financial management.

Cost-positive and timely delivery

By adapting to evolving fiscal and accounting system changes, we reduce costs and mitigate liabilities for you.

Adding value with reliability

By building trust and reliability, we create value that boosts your company's prospects.

Get Latest Updates of Industry

As the calendar turns to 2024, tax professionals face a new landscape of IRS tax code changes that will impact how they

As we step into 2024, small business owners must navigate a new landscape of tax laws that will significantly impact their operations and financial planning.

The landscape of cryptocurrency taxation continues to evolve, and 2024 brings significant regulatory changes that every